This past month, I enjoyed some time with my family and a break from the headlines that we’ve been hammered with over the year, while celebrating the holidays. For me, every holiday season seems to have two things in common: a farewell to what has been and excitement for what new things are to come.

It seems that no matter how many holiday seasons or fresh starts we get, we tend to recall the same things. Many of you reading this will have lived through the 2008 crash and are hearing many of the same things today, which will, of course, have you worried about the state of your personal finance and your hopes of creating wealth.

They say that history never repeats itself, but it often rhymes—kind of like how it is now. While the story may be different, we’re reading similar headlines, hearing similar concerns and asking the same questions. What does this mean for my money, and should I still be investing? Keep reading as I will answer these questions and more.

Bear Markets and

Recessions in Perspective

You’ve likely heard the terms “bear market” and “recession” recently, so I’ll start by clarifying the relationship between these two events. There is a difference between a bear market and a recession. A bear market is marked by a 20% decline in an asset, while the classic definition1 of a recession “is a significant decline in economic activity that is spread across the economy and that lasts more than a few months.”

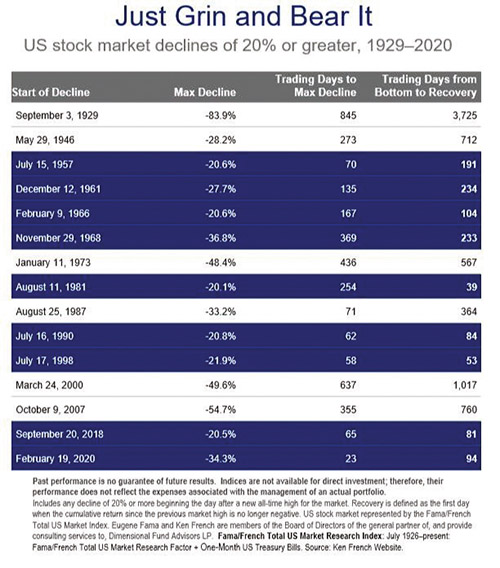

Bear markets can happen outside recessions, but many times bear markets happen when people forecast a recession. The events we are experiencing now have happened before, in fact, since 1929 this is the 16th time in our history that we’ve had a bear market. The only difference between these events is the level of decline and the number of days that this period lasted.

In fact, as witnessed by the below chart, in nine out of the past 15 bear markets since 1929, investors who stayed the course made back their losses within a year.

Rampant inflation, extreme tightening from the Fed, external geopolitical tensions—we’ve seen, heard and lived through all of this before. This bear market may be different from those we’ve experienced before, but in many ways, it’s the same.

From my experience of investing since the age of 10, no one can reliably predict the magnitude of a market decline or the time to a recovery. Rather than guessing, sticking to a plan and resisting the urge to sell amid a decline often allows investors to capture the rebound when it occurs.

Times like these are when discipline comes in handy!

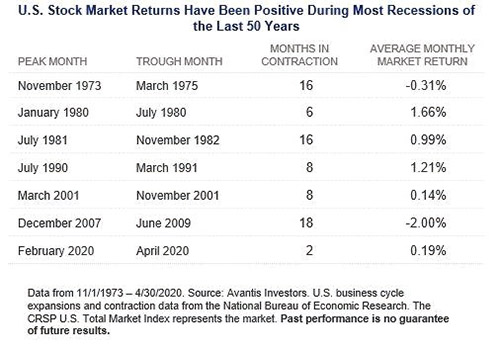

Especially when it seems that all the media wants to do is strike fear into people without proper context of the facts. With this said, if you look at the past seen recessions since 1973, five had positive returns during the recessionary time. Why? Because markets are discounting mechanisms. They are discounting potential slowdowns prior and the recoveries to come post.

But what does this mean for you?

Advice for

Long-Term Investors

Let’s start with long-term investors, both veterans and those new to investing—or who I like to call HENWYs (high earners not wealthy yet). The advice is simple: Keep calm and invest on! Markets change, but markets are tangible; they are people, businesses, governments. The history of humankind has proven that people want to live a better life tomorrow than they are living today.

So we will adapt, we will recover; it’s simply a matter of time. This period may be painful, but, as my grandfather Julius used to tell me during times of struggle, this too shall pass.

You can also come out to the other side with a smile if you take the opportunity that is being presented to you. If you walked into a store and your favorite pair of shoes were on sale, you’d get excited, wouldn’t you? So why don’t you experience the same feeling when your favorite businesses do? This is what is happening now. Some of the best businesses, the businesses that the likes of Warren Buffett and Charlie Monger built their fortunes with, are going on sale and if the headlines are anything to go by, the discounts might get better. However, history has proven that these discounts do not last forever.

Advice for Retirees and Savers

If you need your money to live off or you want to grow your savings, rising interest rates are good news! This means that expected returns are finally rising, which means that savings accounts, bonds and more are finally producing yields. Rates of return of some savings accounts are no longer a joke, and you can even get a two-year Treasury bond with a yield of 4%-plus (as of writing this article).

In short, expected returns are rising, which means that you can get greater rewards for the same level of risk.

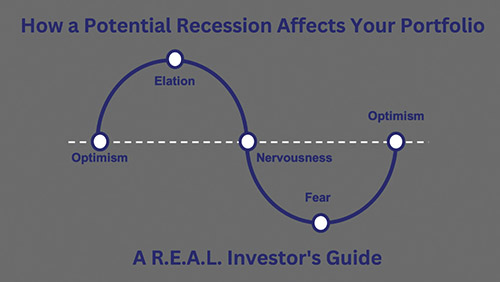

R.E.A.L. Investors Should Win Out

The message here is the same message us cool kids would tell each other growing up in the 90s: Keep it real. No, this isn’t a continued effort to (try to) be cool, but an attitude to get through this and any future bear markets (unfortunately, they will come again).

Relax

Everyone

Act

Long-term.

Be R.E.A.L. By doing so, you will not only see through the clouds of the current storm, but you will be able to capitalize on the opportunities that are currently being presented to you.

Being a R.E.A.L. investor should allow you to generate real wealth, no matter what animal they are using to describe the state of the market. It’s how Buffett did it. It’s how I did it, and it’s how you can do it, too.

This piece contains general information that is not suitable for everyone and was prepared for informational purposes only. Nothing contained herein should be construed as a solicitation to buy or sell any security or as an offer to provide investment advice. The information contained herein has been obtained from sources believed to be reliable, but the accuracy of the information cannot be guaranteed. Past performance does not guarantee any future results. For additional information about Julius Wealth Advisors, including its services and fees, contact us or visit adviserinfo.sec.gov.

1. Business Cycle Dating Procedure: Frequently Asked Questions—National Bureau of Economic Research. https://bit.ly/3VTgnzE

Jason Blumstein, CFA® is the CEO & founder of Julius Wealth Advisors, LLC (www.juliuswealthadvisors.com) a registered investment adviser. He is also the host of “The Big Bo $how” podcast available on Spotify and Apple Podcasts. Jason has been investing and educating himself on personal finance since the age of 10. His company’s mission is to empower people to live their best financial lives, while fostering an ecosystem of integrity, knowledge and passion. Jason resides in Englewood with his wife and two children. He can be reached at (201) 289-9181 and/or [email protected].