What are seller’s concessions a/k/a seller contributions? Answer: Negotiable dollar amounts that the seller pays toward closing costs on behalf of the buyer on a residential purchase transaction. Closing fees vary by geographic and these “dollar amounts” can include, but are not limited to:

Discount points/origination fees

Credit report fees

Title insurance

Processing/underwriting fees

Attorneys/legal fees

Appraisal fees

Up-front mortgage insurance—VERY POWERFUL!

Origination fees

Inspection fees

Transfer, mansion or mortgage taxes

Real estate tax escrows

Prepaid interest

Homeowner association dues (if a condo)

Maintenance (if a co-op)

So why would the seller be so generous as to contribute to your buying their house? Why would anyone selling a home pay the home buyer to buy it? Very simple answer—it’s mutually beneficial for both parties. How so? For the buyer, seller concessions can reduce closing costs with some tax advantages. For the seller, it can accelerate the dealmaking process, and help them sell their home faster.

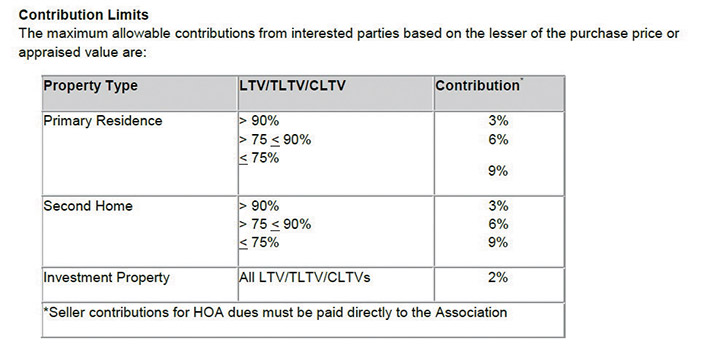

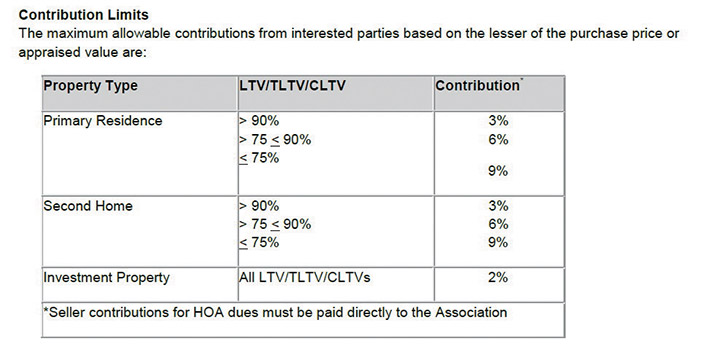

The big, important secret, which many buyers and sellers find out much later in the transaction, is that there are specific underwriting guidelines as to what is acceptable as a seller’s concession, and limitations and caps on how much a seller is allowed to pay. Amounts can range from 2 to 9 percent of the purchase price or the lower of the home’s appraised value. The actual concession depends on the type, program and category of mortgage the buyer gets.

General tips on structuring seller’s concessions:

1. Some parties negotiate a lower purchase price instead of a contribution toward closing costs. Do an analysis as to where you get a bigger bang for the buck, e.g., lower purchase price vs. cash at closing.

2. Some parties increase the purchase price to cover closing costs paid by the seller at closing. Please make sure that a contract is not submitted with multiple cross outs of the initial purchase price and a higher purchase price. Start new and clean, and…. Make sure the appraised value has a chance of supporting the new, higher purchase price.

3. This may be hard, but always try and submit the final concession terms way in the beginning. If you wait until the end, you may postpone your closing because the final closing numbers may have to be adjusted and, worse, the appraised value may be affected. Know ahead of time the best way to structure and what you need to know to prevent delays on closings.

FHA Seller Contributions:

Interested Party Contributions are limited to 6 percent.

Fees Not Included in the Contribution Limitation

Fees typically paid by the property seller under local or state law, local custom such as real estate commissions, charges for pest inspections, fees paid for trustees to release a deed of trust, etc., are not considered contributions that must be counted in the 6 percent limit

Real Estate Commission

Sales commission consistent with the prevailing rate but not to exceed 6 percent. Anything exceeding this amount is considered a sales concession and that excess commission and/or bonus must be deducted from the sales price.

The appraiser is required to disclose whether the purchase contract was reviewed and, if so, comment on any excessive sales commission. Any excessive sales commission should be taken into consideration when arriving at the final value.

Fees for Builder Forward Commitments

Fees for builder forward commitments that a builder obtains for blanket coverage before it enters into a contract with a borrower are not subject to contribution limits because they are not attributable to the specific mortgage transaction.

VA Seller Contributions:

A maximum of 4 percent of the value of the property as indicated on the Notice of Value (NOV) may be contributed from an interested party (property seller concession) to be applied toward closing costs and/or prepaid items.

Any property seller concession or combination of concessions that exceeds 4 percent of the established reasonable value of the property is considered excessive and unacceptable for VA-guaranteed loans. A reduction of the sales price in the amount equal to the excess is required in these instances.

Property seller concessions include, but are not limited to, the following:

Payment of the VA funding fee

Prepayment of the veteran’s property taxes and insurance

Payment of additional discount points to provide permanent interest-rate buydowns.

Provision of escrowed funds to provide temporary interest-rate buydowns.

Payoff of credit balances or judgments on behalf of the veteran.

Property seller concessions do NOT include:

Payment of the veteran’s closing costs.

Payment of points as appropriate to the market. Example: If the market dictates an interest rate of 7.50 percent with two discount points, the property seller’s payment of the two points would NOT be a property seller concession. If the property seller paid five points, three of the five points would be considered a property seller concession.

Now, get your deal going, negotiate a favorable and mutually beneficial seller concession and ….. Go get your hot dog!

By Carl Guzman

Carl Guzman, NMLS# 65291, CPA, is the founder and president of Greenback Capital Mortgage Corp., a Zillow 5-star lender http://www.zillow.com/profile/Greenback-Capital/Reviews/?my=y. He is a residential and reverse mortgage financing expert and a deal maker with over 26 years’ industry experience. Carl and his team will help you get the best mortgage financing for your situation, and his advice will save you thousands! www.greenbackcapital.com [email protected].