Approximately 3 in 4 Buyers Have Regrets About Their Home Purchase, according to a recent American Home Buyer survey from Anytime Estimate. As reported by CNBC, 30% of respondents said they spent too much money on their recent home purchase. Similarly, 30% of those surveyed said their regret was that of feeling pressured. 26% of participants indicated they rushed into the decision and bought too quickly.

I read through the survey several times and saw many fascinating assessments regarding the different regrets these home buyers expressed. While “price” is often a common concern, I think it’s fair to say that anyone who bought a home over the past two years “is in the money” regarding their home value. I certainly don’t want to dismiss the concern, but what I did want to focus on was the most common of the regrets: “feeling pressured” or “being rushed” in the process.

I have been in the real estate and mortgage industry for over twenty years, and I find it disturbing that people felt pressured or rushed into making a home-buying decision. Pressure tactics are not uncommon in the business of sales, but it’s disheartening when it’s regarding something as significant as buying a home.

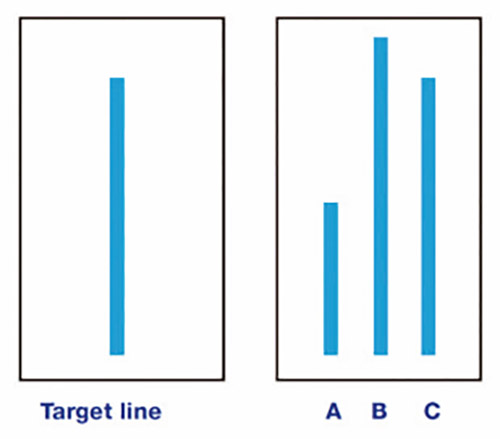

There is a famous experiment called “The Solomon Asch Conformity Experiment.” In this exercise, Asch tested many groups of students with a seemingly simple “vision test,” requesting participants to match up two apparent lines. There was a “target” line in one box, and there were three choices of bars for which participants were asked to match one of them to the target line.

The comparison was blatantly obvious. The experiment, however, had groups of eight people per test, seven of which were “planted” with only one actual “subject participant.” Each answer was said out loud by the fake participants, all of whom deliberately gave the wrong answer to a blatantly smaller line that didn’t match up.

When faced with the pressures of diverting from the group, the unsuspecting victim agreed with the other participants that the smaller line matched the target line. This trial was repeated many times, and in most cases, the “subject participant” agreed with the crowd despite knowing their answer was wrong.

Peer pressure and social tactics can be a dangerous phenomenon. This anxiety can be seen in how our children and we react to what we see on social media, as well as the age-old “keeping up with the Joneses syndrome.” In all my years, I don’t recall ever hearing people begrudging their home buying decision because of pressure tactics. Indeed we are in a changing world, but one I caution need not be by looking over our shoulders competing with someone else. As always, working with an experienced professional renowned for service, integrity, and trust is vital!

Shout out and happy birthday to Mark Bauman, Elie Borger, Dov Goldman, Aaron Gordon, David Hochstein, Danielle Karoly, Ora Kornbluth, Elizabeth Kratz, Sivan Krug, Hillel Lazarus, Moshe Lewis, Rafi Moskowitz, Elliot Rosenfeld, Yossi Sausen, and Rabbi Ariel Schreier

Shmuel Shayowitz (NMLS#19871) is a highly regarded Real Estate & Finance Executive, Writer, Speaker, Coach, and Advisor. He is President and Chief Lending Officer of Approved Funding, a privately held national mortgage banker and direct lender. Shmuel has over twenty years of industry experience, holding numerous licenses and accreditations, including certified mortgage underwriter, licensed real estate agent, residential review appraiser, and accredited investor, to name a few. Shmuel has successfully navigated through many changing markets and business landscapes, making his market insights and experience well coveted within the real estate industry. He can be reached via email at [email protected].