In May 1961, President Kennedy announced an initiative to safely land an American on the moon before the end of the decade, and before the Russians. The National Aeronautics and Space Administration’s Apollo space flights were scheduled to meet that deadline, but encountered some serious setbacks, the worst of which came in January 1967 when a cabin fire during a launch rehearsal killed all three astronauts on board. Now, after several redesigns and tests, NASA was ready in 1968 to resume manned space flights. But before heading into space, NASA had a pragmatic financial problem to resolve.

As proven by the cabin fire, space travel was a dangerous activity, so much so that someone suggested the Apollo astronauts might want to consider getting flight insurance, sort of like the type offered at kiosks in airports. It was a good idea, but there were two problems: Insurance companies either didn’t want to assume the risk, or the premiums they quoted were prohibitive.

True to their engineering spirit, someone at NASA came up with a workaround: autograph covers. In an August 2012 article on NPR, space historian Robert Pearlman explained an ingenious way the astronauts turned the risk of not surviving a space flight to their financial advantage.

In the 1960s, astronauts were national heroes whose fame far exceeded most entertainers or athletes. Successful space flights were followed by ticker tape parades, visits to the White House, and appearances on the “Ed Sullivan Show.” This notoriety, along with the public’s awareness of the dangers of spaceflight, created a unique “insurance” opportunity.

Prior to launch, each astronaut crew from Apollo 11 through 16 was given hundreds of postcards to sign. As famous people, their signatures were valued by collectors. Pearlman notes that “these astronauts had been signing autographs since the day they were announced as astronauts, and even though eBay didn’t exist back then, they knew that there was a market for such things.”

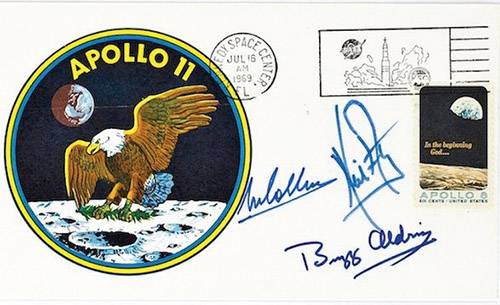

An “autograph cover” is a signed postcard that has been postmarked to coincide with a significant event. Before launch, the astronaut gave his stack of postcards to a friend, with instructions: On important days during the mission—the liftoff, the day the astronauts landed on the moon, the reentry, etc.—a portion of the cards were to be postmarked, then given to the astronaut’s family.

In the event of a fatality, autograph covers from the date of the tragedy would have immense value to collectors. “If they did not return from the moon, their families could sell them—to not just fund their day-to-day lives, but also fund their kids’ college education and other life needs,” says Pearlman. It was life insurance in the form of autographs.

Fortunately, these “life insurance covers” were not needed. Although there were some tense moments during the Apollo 13 mission, all the Apollo astronauts returned safely. And during their lifetimes, Pearlman guesses the Apollo astronauts probably signed tens of thousands more autographs, for free. Yet despite the abundance of astronaut autographs in circulation, Pearlman reports that in the 1990s some of the space flight autograph covers started showing up in memorabilia auctions, and today, an Apollo 11 insurance autograph cover (from the mission that featured the first lunar landing) has a sale price of $30,000.

Besides being an interesting bit of life-insurance trivia, the Apollo insurance covers represent a unique outside-the-box solution to protecting an individual’s economic value. In the case of the astronauts, it wasn’t poor health that disqualified them from getting life insurance, but the dangers of their occupation. And ironically, it was the high likelihood of dying that made this “insurance” viable.

Autograph covers are a vivid example of the lengths people will go to “make insurance” when they find they can’t get it any other way, and confirms the adage “By the time most people recognize the value of insurance, it’s often too late to get it.”

This article was prepared by an independent third party. Material discussed is meant for general informational purposes only and is not to be construed as tax, legal or investment advice. Although the information has been gathered from sources believed to be reliable, please note that individual situations can vary. Therefore, the information should be relied upon only when coordinated with individual professional advice.

Registered Representative and Financial Advisor of Park Avenue Securities LLC (PAS), 355 Lexington Avenue, 9 Fl., New York, NY 10017, 212-541-8800. Securities products/services and advisory services offered through PAS, a registered broker/dealer and investment adviser. Financial Representative, The Guardian Life Insurance Company of America (Guardian), New York, NY. PAS is an indirect, wholly owned subsidiary of Guardian. Wealth Advisory Group LLC is not an affiliate or subsidiary of PAS or Guardian.

PAS is a member FINRA, SIPC.

Neither Guardian, PAS, Wealth Advisory Group, their affiliates/subsidiaries, nor their representatives render tax or legal advice. Please consult your own independent CPA/accountant/tax adviser and/or your attorney for advice concerning your particular circumstances.

2017-34878 Exp 1/19

Submitted by Elozor Preil