This is possibly the most challenging time to be an asset allocator. All major asset classes, including stocks, bonds and real estate, are at or near record levels. The froth in asset prices is not only clear from broadly accepted valuation benchmarks, but also evidenced by growing speculation in novel asset classes such as cryptocurrencies, NFT’s, meme stocks and SPAC’s. The dislocations caused by the pandemic, and the resulting actions taken by governments, businesses and individuals, have caused a number of market anomalies that have left even professional investors in a quandary. Moreover, there are growing jitters about rising inflation, unconventional interest rate policies, soaring government debt, prodigious fiscal spending, and geopolitical tensions.

How should an investor attempt to assimilate these uncertainties in the context of managing one’s portfolio?

Historical Perspectives: Inflation in the 1970s

Let us take a deeper dive into the subject we highlighted in last month’s column—inflation. We are seeing inflation’s effects in nearly every corner of the economy. We highlighted many macroeconomic factors that are driving inflationary pressures. But the question for an investor is how sustained levels of inflation will impact one’s investment portfolio.

Perhaps a historical analog could provide some insight into how portfolios perform during prolonged periods of high inflation. For example, looking back at the inflationary 1970s, we can see some clearly distinctive performance metrics of various asset classes over that decade.

A Deutsche Bank report (“The Age of Disorder”) shows that a conventional approach to portfolio management (i.e., stocks and bonds) led to poor returns. Because of the elevated level of inflation during that period, both stock and bond returns failed miserably in keeping up with inflation. The report showed that while nominal 30-year bond yields were much higher than today’s levels, “real” returns (adjusted for inflation) were abysmal, at -3.43% per year. What that means is that a 30-year bond investment over that decade would have resulted in a compounded loss of about 30% of buying power. During the same decade, many commodities and stocks of commodity producers such as oil, gold and metals performed rather well. To be clear, while these data points are not conclusive, they could be instructive regarding the risks of traditional investment styles in today’s markets.

Taking a Step Back

Over-reliance on historical analogs has its own challenges. The global economy is markedly different today than it was in the 1970s. Even if the thesis of secular inflation holds true, the global economy is significantly more integrated and technologically advanced than it was in the 1970s. Moreover, one of the main culprits in the 1970s, the OPEC oil embargo, is much less of a concern today because of OPEC’s decreasing influence in shaping the global energy markets. Finally, one can argue, like Federal Reserve Chairman Jay Powell, that the pandemic caused idiosyncratic imbalances in the markets that will sort themselves out in the not-too-distant future.

Focusing on Real,

Not Nominal, Returns

With any investment, there are many microeconomic and macroeconomic risk factors to consider given the economic climate that are not necessarily comparable to prior periods. During the past decade, performance of U.S. equities was driven to a large extent by exposure to the “FAANG” stocks (Facebook, Alphabet, Apple, Netflix, Google). The successful performance of these companies was not only dependent on their growth trajectories, but also by the “goldilocks” economy in the years following the financial crisis. This environment was characterized by modest economic growth, low inflation, and historically low interest rates.

But given the persistently rising rates of inflation this year (the latest CPI inflation reading was the highest since 1990), the goldilocks era may be coming to a close. Investors are cautioned to consider some of the newer risk factors in their asset allocation process. If one believes that inflation is here to stay for a while, one might favor stocks of companies whose performance is tied to higher commodity prices. Conversely, a company that lacks “pricing power” is likely to struggle in this environment.

With regard to bond investments, sustained inflationary pressures could cause the Federal Reserve to act with more alacrity on its path to normalization of interest rates. Bonds with long-dated maturities and many highly priced growth stocks could fall victim to an accelerated pace of interest rate increases. While we are not suggesting that these asset classes should necessarily be avoided completely, one should consider alternatives that are better suited for the evolving macroeconomic environment.

Time to Cash In?

In past periods of elevated risk, cashing in one’s investments and sitting in money market funds was a reasonable alternative. But with inflation rising and money market funds yielding close to zero, the real return of cash and money market funds is a near guarantee of losing real wealth and therefore not a silver bullet by any means.

Is Your Portfolio Positioned For Long-Term Success?

While we highlighted inflation and its impact on portfolio returns, there are also many other macroeconomic uncertainties facing the global economy that require deep consideration. How will the unwinding of the aggressive fiscal and monetary policy affect markets and aggregate demand? Is the housing market overheated and could an unwinding of the market wreak havoc as it did during the financial crisis? To what extent will the changes in remote working normalize? Is the global supply chain permanently impaired and how will corporations respond?

The best long-term investors have the ability to understand market risks and even take advantage of the evolving macroeconomic trends. The challenge of developing a process to attain “real” portfolio growth while minimizing risk is formidable, especially in the current environment. Is your portfolio prepared for the multiple uncertainties that lie ahead? How may this impact your financial future?

The views presented are those of the authors and should not be construed as personal investment advice or a solicitation to purchase or sell securities referenced in this market commentary. The authors or clients may own stock or sectors discussed. All economic and performance information is historical and not indicative of future results. Any investment involves risk. You should not assume that any discussion or information provided here serves as the receipt of, or as a substitute for, personalized investment advice. All information is obtained from sources believed to be reliable. However, we do not guarantee the accuracy, adequacy or completeness of any information and are not responsible for any errors or omissions or from the results obtained from the use of such information.

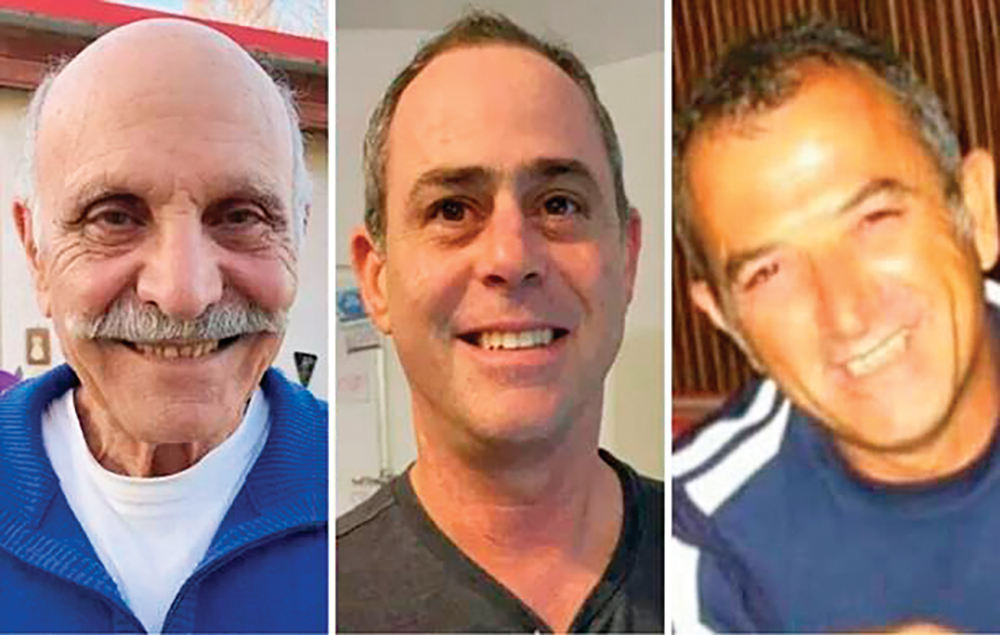

Jonathan D. Caplan, a former Wall Street executive, is president and founder of wealth management firm Caplan Capital Management, Inc., with offices in Highland Park and Hackensack. He holds a BA from Yeshiva University and an MBA in finance from New York University Stern School of Business. You can find other recent investment articles by Jonathan at www.caplancapital.com/blog.

Joseph Caplan is a vice president of investment strategy at Caplan Capital Management. He received his BA in economics from Rutgers University.