As a society, we often do everything we can to avoid uncertainty. Whether it’s checking the weather before we leave the house or getting insurance to protect us from unfortunate events, we do what we can to avoid uncertainty. This is especially true when it comes to our money. Ask anyone about investing, and I bet that they’re looking for the least amount of risk with the best possible returns. While this sounds great, I’m sad to say that this utopia doesn’t exist in our world.

Instead, we must deal with the market that we do have, which is uncertain and volatile. People drive themselves crazy thinking about uncertainty, entertaining a string of “what ifs?” and “maybes.” The thing is, the only thing that is certain in life—aside from death and taxes—is uncertainty. We see this in the market every day, and I discussed in my last article, this isn’t always a bad thing. In fact, here at Julius Wealth Advisors, we believe this volatility is what causes people to historically have better longer-term investing results in equities than those who choose the safer option of treasuries, or stuffing their cash in a mattress.

I often get asked by clients how to manage wealth during uncertainty and volatility, so I thought it was time to address it. So, here is your guide on how to manage your wealth amid these “uncertain’’ times..

Step 1: Check Your Balance Sheet

As a trained CFA Charterholder, I learned that the first place one should look when analyzing a business is the balance sheet. I often say that you are the CEO of your family business, and every good CEO understands the balance sheet of their company. Thus, this is where you should start as well. A healthy balance sheet should have ample liquidity, a reasonable amount of leverage and an absence of excessive debt. While debt is often believed to be “a four-letter word,” understanding the structure of your balance sheet to me is a more important place to start.

Liquidity or true cash is important, as it allows you to have a level of psychological safety. The common advice is to have 6-12 months of expenses in cash. However, I have found this to be a more nuanced equation depending on each person’s situation. A mistake often made is that people see liquidity and equity as the same thing. With home prices rising substantially over the past couple of years1, you may have a level of equity in your home, but this money is trapped. You can’t use it unless you want to sell your home. Re-financing could only be an option if you can get a better interest rate. However, given the current spike in interest rates2, this is very unlikely. Instead, a suggestion would be to get a line of credit,like a Home Equity Line of Credit (HELOC)3, that allows you to access your equity without locking yourself into a higher interest rate. While the rate will most likely be variable in nature, consider the blended rate received combined with your mortgage. Not to mention the potential tax benefits4 (please consult with your tax adviser). This is something that not many people consider or even know about. This is just one example of a source you can use to contribute to your liquidity.

Step 2: Look at Your Cash Flow

In the simplest of terms, your cash flow is your income minus expenses. If you are paid through a salary, as most of us are, your income is hard to change. Not many of us have the luxury of being able to demand more money from our employers whenever we like. You can always look into taking on more work or creating a side hustle, but this simply means sacrificing more time that could be spent with your loved ones. A better use of your time would be to examine your expenses.

Expenses should be categorized into needs versus wants. You need to pay for your car, health insurance, electricity and cover your mortgage. These are the essentials and must be separated from the things that you want, but don’t necessarily need. For example, you need to eat, but you may want to order take-out instead of eating the food you already have in your fridge.

Cutting down on wants is a good way to increase your cash flow. While it might not seem meaningful, a good place to start is by looking at your subscriptions. I’m sure that you’ve probably signed up for one or two companies that you don’t use enough to justify the monthly payment. I’ve seen this especially to be true post COVID-19, when many people were stuck at home. Many of these subscriptions are easy to get out of, so don’t be afraid to start canceling a few of them.

Another tip I recommend is to categorize paying your future self as a needed expense. This is an amount that you set aside for the future. This leads us nicely into our next step.

Step 3: Making Investments

Steps one and two are important, so you can get to step three, as we’ve found it important to not stop the miracle of compounding5 during downturns. Our investment philosophy is guided by the principles of Warren Buffett and Jack Bogle, which emphasizes owning high-quality assets for decades, not days, while seeking downside protection and controlling the drag of cost and taxes. While we believe this to be a time-tested philosophy, we tell people we expect it to be successful over time, but not all the time. This “not all the time” typically takes place during periods of “uncertainty” in the world. However, this is where the much-maligned volatility becomes your investment opportunity.

I’ve often found it to be sadly comical that if a pair of Nike shoes go on sale for say 20-30 percent off, people will run to buy them (pun intended). After all, everyone loves a bargain. However, if Nike’s stock goes down 20-3 percent, no one gets excited. In fact, they often do the opposite, they run away. In this example, I use Nike as a proxy for investing in equity markets as a whole.

What I believe you need to do instead is view these dips as your chance to buy the best businesses at a discounted price. If you are invested in the highest quality businesses, they should bounce back historically speaking, survive the brief period of volatility and continue to grow.

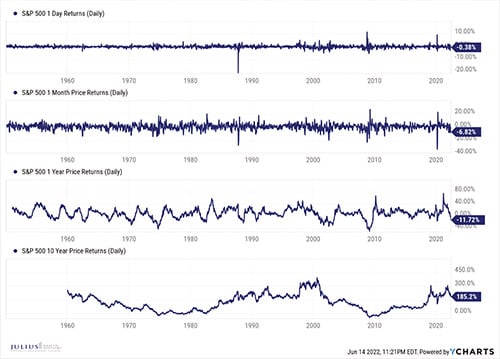

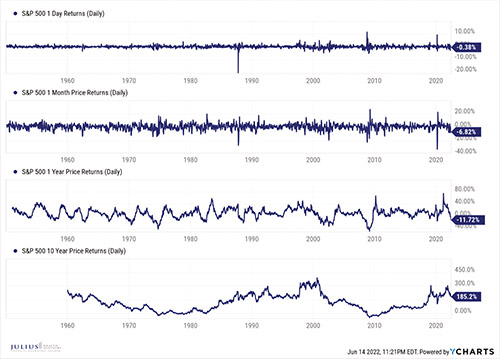

See what happens when you zoom out over time when viewing a chart of the S&P 500. The above shows the 1-day, 1-month, 1-year, and 10-year returns of the S&P 500. The shorter-term time frames look like a bunch of noise on a microphone recorder, while the longer-term data starts to actually filter this noise out. Hence, this is why we believe short-term volatility can be key to your future wealth.

Step 4: Change Your Behavior

I often discuss how emotions and creating sustainable wealth do not mix. If you let your emotions drive your decisions, you’ll often fall into common traps that keep people from achieving their financial goals. Part of the goal of the steps in this guide is to create a form of psychological safety. The point is that through these behavioral changes, you can remove emotion from your decisions and focus on the real numbers and data of your financial choices.

As I discussed on my most recent podcast, the Big Bo $how, this is why I believe that behavioral coaching is so important. Emotions lead to cashing out during dips, jumping onto investing bandwagons, and focusing on your wants instead of your needs. Furthermore, uncertainty creates a strong emotional response which can impact your ability to make better financial decisions, therefore damaging your ability to create sustainable long-term wealth.

Final Thoughts

If you take one thing away after reading this post, its uncertainty is a constant when it comes to your wealth. Whether it’s war, politics, rising interest rates or any other event, there will be at least something that causes you to worry about your finances. The trick isn’t to attempt to avoid it, as this is impossible.

Instead, seek to follow the steps in this guide, change how you view uncertainty and contact us to help implement these processes and behaviors into your life.

Jason Blumstein, CFA® is the CEO and founder of Julius Wealth Advisors, LLC ( www.juliuswealthadvisors.com ), a registered investment adviser. He is also the host of The Big Bo $how podcast available on Spotify and Apple podcasts. Jason has been investing and educating himself on personal finance since the age of 10. His company’s mission is to empower people to live their best financial lives, while fostering an ecosystem of integrity, knowledge and passion. Jason resides in Englewood with his wife and two kids. He can be reached at (201) 289-9181 and/or [email protected].

Disclosures

This piece contains general information that is not suitable for everyone and was prepared for informational purposes only. Nothing contained herein should not be construed as a solicitation to buy or sell any security or as an offer to provide investment advice. Past performance does not guarantee any future results. For additional information about Julius Wealth Advisors, including its services and fees, contact us or visit adviserinfo.sec.gov.

References

1. Median Home Sales Prices US: St. Louis Fed Economic Data fred.stlouisfed.org

2. Freddie Mac Primary Mortgage Market Survey: FreddieMac.com

3. Need cash? Here are two options for homeowners: Investopedia.com

4. Interest on Home Equity Loans Often Still Deductible Under New Law: IRS.gov

5. Why Einstein Considered Compound Interest the Most Powerful Force in the Universe: www.Inc.com