With the chagim over, the Medicare Annual Enrollment Period (AEP) is here. This is the time of year when you are allowed to sign up for an Medicare Advantage or Part D drug plan without a special election circumstance. Even if you are already enrolled in one of these plans, it’s worth looking into other plans during AEP to make sure that your current plan will still be the best for you in the upcoming year. Let’s take a look at what this enrollment period is and how you can benefit from it.

The AEP, which runs from Oct. 15-Dec. 7, is the unique point in the year where insurance companies release their rates for the new year and allow you to enroll in a plan, no questions asked, for a Jan. 1 effective date. Every year, the various insurance companies change premiums, drug tiers and formularies on all of their plans. For example, last year there was an insurance company that raised their premiums by over 60%.

Many customers were unaware that this change was happening and were very unhappy when they saw their bills once the year turned on the calendar. Therefore, if you are already enrolled in a Part D drug plan, it makes sense to check that your current plan isn’t raising your premiums through the roof or changing the tiers on your medications to make them more expensive.

Additionally, you might be taking different medications then when you first enrolled in your drug plan and a new plan may offer better coverage for the new medications. During AEP, you are allowed to switch your plan to save you money and to secure better coverage for the new year. Even if you have Medicare and have never enrolled in a Part D drug plan, you are allowed to enroll in the drug plan of your choice during the AEP.

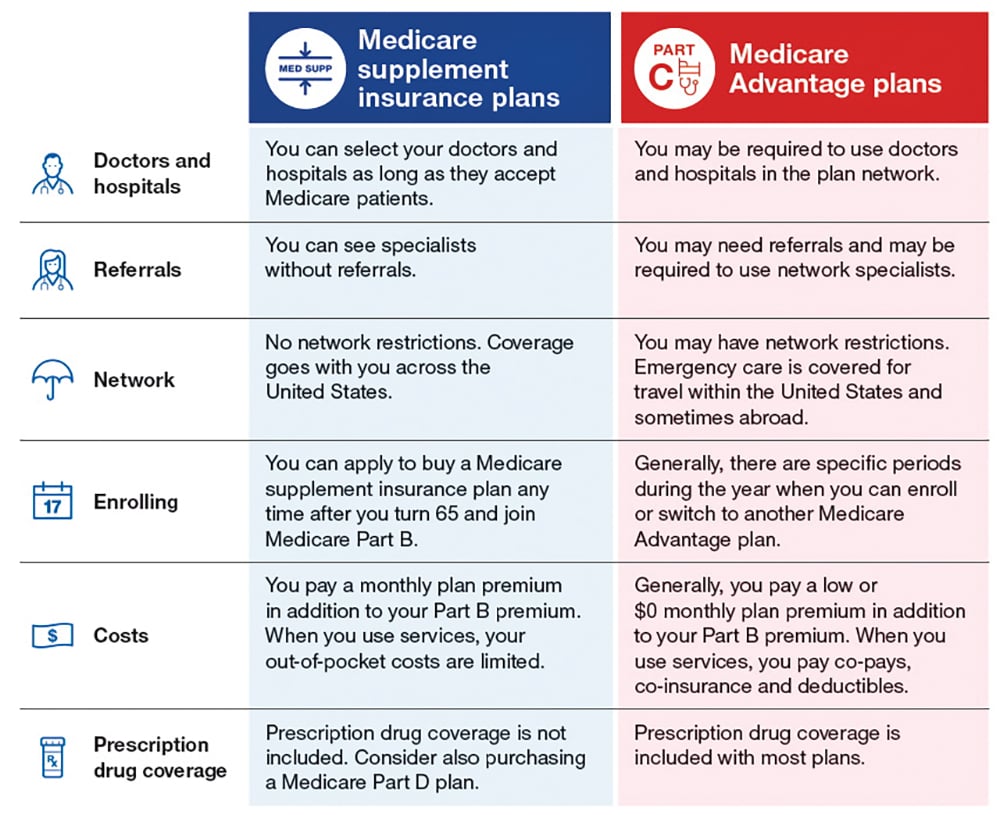

Another interesting facet of the AEP is the flexibility offered to those with Medicare Advantage plans. If one has an advantage plan, they are able to switch to a new advantage plan if they want. Also, if they no longer like being on an advantage plan, they are allowed to switch back to original Medicare by enrolling in a Part D drug plan. Note that this would mean that they would also need to find a supplement plan (Medigap) as well to replace their advantage plan. If you choose to switch your plan, whether that means from advantage to advantage; advantage to a Part D drug plan; or a Part D drug plan to a different Part D drug plan; all you have to do is enroll in the new plan and the old policy will automatically cancel on Dec. 31.

But what if you like your current coverage and want to stick with it? Then you’re in luck! You don’t have to do anything and it will automatically renew for the new year; no action needs to be taken. Hopefully this article was able to provide some clarity as to what you have to do during Medicare AEP to ensure that once the new year rolls around, you can avoid those unnecessarily high bills and keep those hard-earned dollars in your pocket.

If you or someone you know is turning 65, retiring or losing employer coverage, feel free to reach out to Medicare Menachem (Michael) Friedman at (347) 738-6846, at insurancemd@gmail.com, or visit his website at mindfulmedicaresolutions.com. He is a licensed Medicare insurance broker in 20 states, an expert in navigating the maze of Medicare, and has been providing a priceless service to his clients for over 15 years without ever charging a price.

Josh Goldenberg is a staff writer at Mindful Medicare Solutions.