There is no question that leading an observant Jewish lifestyle takes a lot of money and sound budgeting. To help families navigate these challenges, the Orthodox Forum of Highland Park/Edison offered a webinar “Managing Finances Throughout the Jewish Life Cycle,” which featured three local financial experts who provided guidance to families planning their future financial obligations.

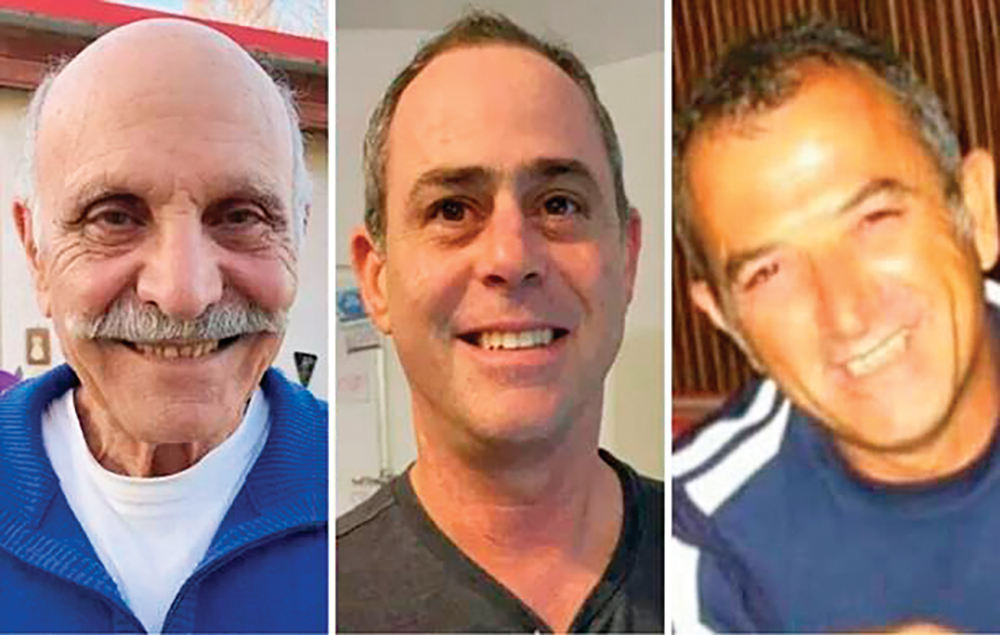

The presentation started with Jon Caplan, president and CIO of Caplan Capitol Management, who noted that the average Orthodox family of four has twice the expenses of a regular family of the same size. He continued that “while some families are affluent, many are feeling this heavy burden.” He acknowledged that while there is no “silver bullet” to solve the problem, there are some things that can be done to make expenses less onerous.

It is critical to create a budget plan to maximize spending efficiency and to create favorable borrowing opportunities. For example, the cost of the daily caffeine fix at the local coffee purveyor can easily cost thousands of dollars per year. Caplan does not suggest completely eliminating the daily coffee, but to consider alternatives. Would switching to bringing a thermos of brewed coffee be a better option and free up that cash for tuition or a vacation fund? Would a staycation be a better option than a vacation destination that requires airfare? If the desire to go far away needs to be fulfilled, can a less expensive lodging choice a bit further from the attractions be arranged?

The discussion then moved to retirement planning. Starting retirement savings early allows for the advantages of compound interest to maximize funds available when needed. Caplan also urged the audience to take advantage of any matching contributions to 401K plans from employers and to carefully look at tax advantages available to 401K investments.

Tips for favorable borrowing included the options for setting up a home equity line of credit (HELOC) to cover a shortfall of cash. Caplan also urged exploring the total costs of car replacement. When factoring in higher loan fees and total maintenance costs, it can be less expensive to purchase a new car rather than a used one. Again, the key concept is to be aware of the costs and make a knowledgeable decision. Lastly, Caplan suggested that using a donor-advised fund and bundling tax deductions over two years can also save money.

Ben Menasha, an elder law and estate lawyer, spoke next about the importance of wills, living wills, and maintaining a durable power of attorney. Admitting that most people don’t like to talk about their death, he asserted that it is a necessity to ensure that your possessions and other end-of-life decisions are made as you would want them. In the absence of a will, the government will distribute your possessions as they see fit—which may be in a manner that goes against your preferences.

Trusts can be put in place for beneficiaries who have special needs or for other reasons that would allow tax benefits. While there is currently no estate tax in New Jersey, there is an inheritance tax. The laws change regularly, and Menasha advised that wills and trusts be reviewed regularly to compare with any new laws, adding that Jewish law does not recognize a last will and testament, but one can be prepared that does not go against halacha.

Halachic living wills and advanced directives can be prepared that would require the input of local rabbis in the event of incapacitation of an individual. In the absence of a living will or advanced medical directive, hospital employees will make medical choices that may not agree with halacha. Powers of attorney provide written documentation to allow your selected representative to act on matters on your behalf. Financial institutions are not required to adhere to a power of attorney designation if they believe the paperwork is outdated, so these documents should be updated at least every 10 years.

Dan Rushefsky, investment advisor with Capital Financial Associates, then discussed the advantages of various types of insurance to weather any potential financial storms. He noted that while it is common for people to insure items of value (home, car, jewelry, vacations booked in advance), many don’t think to insure their income. It is no longer possible to rely on government programs for a comfortable retirement; we need to be proactive and consider long-term care insurance for nursing-home and assisted living, life insurance and income protection if illness prevents a person from working.

Life insurance can meet financial goals and provide some tax benefits as well as investment opportunities. Disability and life insurance can protect families and be beneficial for business partners in the event a person can no longer do their job. Whole life insurance policies work as a financial investment and allow for borrowing against the policy if finances are needed. Financial advisors are available to help customize the right programs and policies for each case. Rushefsky mentioned that people who already have insurance should periodically review their beneficiary listings to make sure they are up to date and are accurately reflected.

In the question and answer period the speakers shared that, for those preparing for aliyah, retirement funds and insurance will pay beneficiaries anywhere in the world that they live, but wills and other documents need to reflect the laws of both Israel and the United States.

Visit orthodoxjewishforum.dreamhosters.com for more information about upcoming and previous programs.