Insurance is not tangible; it’s not something in your hands that you walk out with once purchased. Health, dental and vision insurance are somewhat tangible because you will use it, unlike life insurance. Life insurance is not something you will ever use for yourself; that’s why it is so hard for people to come to terms with purchasing a policy. This doesn’t mean they are selfish; they are just not educated on the topic or believe all the myths about life insurance that are out there.

Most people don’t realize the importance of life insurance. One of the biggest myths around life insurance is that it’s expensive. But so many people overestimated the cost of a term life insurance policy. For example, a 20-year term of $500k for a 35-year-old female is only $17.63 a month, and a 35-year-old male is only $20.64 a month. Doesn’t that seem worth it?

Another myth is that it’s challenging to obtain life insurance. Life insurance is easier now than ever to purchase; most insurance companies now offer plans with no medical exams required. The process is super easy; everything is done online from the comfort of your own home.

Lastly, many couples don’t see the value of purchasing a plan for the stay-at-home parent. They always say, “My spouse doesn’t have an income, so why would they need it?” Well, if you Google it, the average stay-at-home parent is worth approximately $110,000 a year. That’s a lot; if something were to happen to that parent, imagine how much it would cost to hire someone to do all that they did. Getting the stay-at-home parent life insurance protects the other parent’s careers. If something happens to them, do you want to have a choice to work or stay home? Insurance gives you a choice.

Whole Life Vs. Term Life

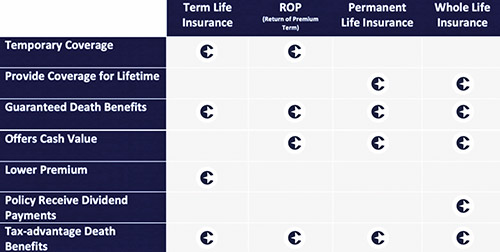

There are different life insurance policies to choose from; some can be used as an investment account to send children to college, marry them off, or be there for a rainy day, while other plans still have your traditional death benefit.

Term life offers benefits only and locked-in premiums for a particular term. You do not benefit a penny if no benefits could be claimed before your policy term concludes.

On the other hand, whole life insurance has a locked-in premium for life, and the money you pay toward the policy is guaranteed to always be there for you. These policies combine the traditional death benefit with a “cash value” that continually grows. In some cases you can use dividends to pay for your premiums. The cash value portion can either be enjoyed now, or it will be there for dependents as an increased death benefit. It’s not a use-it-or-lose-it plan. All benefits, whether enjoyed during your lifetime or posthumously, are 100% tax-free.

A well-designed whole life policy is not an excellent option for virtually all people; there are exceptions. If you cannot afford a whole policy, it would be wise to invest in a less-expensive term policy to provide security for your family. Also, once you reach middle age and up, it typically makes a lot less sense to invest in a whole life policy because it takes quite a few years until a respectable profit builds up. The younger you start, the lower your premiums will be, and the more you’ll earn. In this case—when your objective isn’t savings or modest profit—it makes most financial sense to invest in a death benefit only, all the more so once the insured is no longer young.

You buy life insurance because it’s the best way to protect the ones you love. It’s a financial decision—kind of. It’s an emotional decision—sort of. It’s about love and caring for your family and securing the future—most definitely!

Mark Herschlag is the founder and CEO of Cosmo Insurance Agency, which is based in Ocean County. Cosmo Insurance Agency offers personalized solutions for individuals and businesses looking to obtain health, life, dental, long term care or disability insurance.

For more information or for a free, no-obligation quote, please call (201) 817-1388 or visit www.COSMOINS.COM