If you asked any of your friends, family, or colleagues what their goals for the future were, I’m willing to bet that purchasing a house would come up at some point. After all, this is the great “American dream” that we’ve all been spoon-fed as we were growing up. Get a good job, establish your family, and then put your savings and everything you earn into a family home. Why? Because we’re told it’s a good investment. If you go by conventional wisdom, buying a house is often regarded as one of the best or safest investments that you can make.

The reality is that, like every other personal finance decision, the answer is “it depends.” However, I find that many jump in without a proper understanding, and unfortunately learn it isn’t so rosy. Many families often find themselves weighed down by the “dream home” they’ve worked so hard for, and they are left unable to enjoy the lives this investment was supposed to promise them.

Don’t Buy a House as An “Investment”

If you follow the herd and ignore the numbers, conventional wisdom says that buying a house is always a good idea. The problem is that there are countless people in this country who shouldn’t buy a house. If someone asked my advice on the matter and I believed it was in their best interest not to (which is often the case), I wouldn’t hesitate to tell them that they shouldn’t buy a house. This is because there is a fundamental issue with the idea of home ownership in this country. People work and save and sink everything they have into a home because that’s what they’re “supposed to do.”

I say that this is insanity!

We’ve been brainwashed into thinking we need to own a home, and as a result, countless Americans sacrifice their time, relationships, money, and sanity in pursuit of this dream.

Only a handful of people can afford to purchase a home outright, so the vast majority have to get their money from someone else in the form of a loan. Thus, your home isn’t actually yours until you pay off your loan. You might have the keys and it might be where you rest your head every night, but it doesn’t actually belong to you.

So, who does own your home? Odds are it’s not the bank or mortgage company you interfaced with to get it, as mortgages are chopped up and sold. Then your “lender” just collects a highly profitable recurring servicing fee to collect your money and send it to its new owner. The end owner in about 50% of the situations is the US government via their Government Sponsored Enterprises in Fannie Mae and Freddie Mac.1 This number is extraordinarily much higher for Rocket Mortgages, the country’s largest mortgage originator. If we review their 2022 annual report, 92% of their mortgages originated in 2022 were backed by the government, which is actually down from 98% in 2020.

Hmmm, maybe this is why the herd tells us that home ownership is a great “investment.” They are incentivized to do so! A rule that I have always lived by is that when someone tells me “what,” I always ask “why?”

Should You Buy a House?

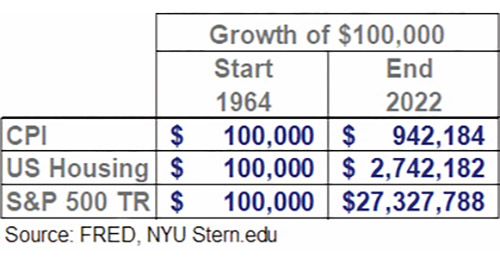

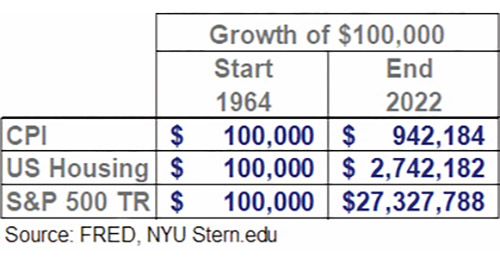

The simplest answer, however frustrating, is that it depends. When making a financial decision, the best place to start is with the numbers. Homeownership is perceived to be an investment because you can one day own your home or sell it for a profit. According to Federal Reserve Economic Data, since 1964 (the latest data they’ve published), the average annual increase in US National home prices has been about 5.9% through 2022. During this same time, CPI (aka inflation) has increased by an average of 3.9%, leaving you with a net real return of about 2% per year on average.

But, wait, there’s more!

Homeownership Costs

If you haven’t gathered this already, owning a home isn’t cheap. First, you need to pay off your monthly mortgage rate with interest. Then, you’ll need to cover any real estate taxes that apply to you (this will vary depending on where you live, and is typically variable in nature). You then need to insure your home and maintain it; these expenses come entirely out of your pocket.

These expenses increase how much you spend on your house over time, adding to its price and conversely, eating into your potential profits. Remember, on average, housing prices only beat inflation by 2%, but when you factor in all the other expenses that you encounter, you might fall behind. If you aren’t beating inflation, you aren’t increasing your real wealth!

In some cases, homeownership can be a tax benefit. However, post The Tax Cuts and Jobs Act of 2017, these benefits can be greatly reduced.2 (Please consult your tax advisor for your specifics.) In this legislation, deductions in mortgage interest and real estate taxes were limited, while your standard deduction was increased. Thus, for many, this means that you might not be getting the tax benefits you thought you were for owning your home.

Rental Costs

As a renter, your costs are pretty fixed. For the length of your lease, you know exactly how much your rent will cost each month. Your utilities will be within your control to a certain degree, and any repairs or issues with the property should be covered by your landlord.

Rental payments are often referred to as “dead money”. This would imply that you’re spending money and getting nothing in return, which simply isn’t true. While you may not own the home that you’re living in, you still get a roof over your head.

Homeownership and Investment

Growing your wealth comes down to how you allocate your capital. And with this comes choices. One of those choices is investing in American businesses. Using the same time period referenced earlier, since 1964 the average total return on the S&P 500 has been 11.3%. This is 5.4% per year more than US housing and 7.4% more than inflation.

Doesn’t this beg the question whether owning your home is really the best idea? Especially if you are looking to invest your hard-earned cash.

Does it mean you should never own a home? No, I own my home.

At the end of the day, there are times when it’s a good idea to buy a house, and times when it’s not. Buying a house isn’t always an investment or even a good idea. Renting isn’t dead money. Whichever path is correct for you will be determined by your goals, the market, and of course, the numbers.

I’ve helped clients find the right time to buy based on their numbers and I can do the same for you. Take control of your financial future by getting in touch with Julius Wealth Advisors today.

Jason Blumstein, CFA® is the CEO & Founder of Julius Wealth Advisors, LLC (www.juliuswealthadvisors.com) a registered investment adviser. He is also the host of The Big Bo $how podcast available on Spotify and Apple Podcasts. Jason has been investing and educating himself on personal finance since the age of 10. His company’s mission is to empower people to live their best financial lives, while fostering an ecosystem of integrity, knowledge, and passion! Jason currently resides in Englewood with his wife and two kids. He can be reached at 201-289-9181 and/or jason@juliuswealth.com.

This piece contains general information that is not suitable for everyone and was prepared for informational purposes only. Nothing contained herein should be construed as a solicitation to buy or sell any security or as an offer to provide investment advice. The information contained herein has been obtained from sources believed to be reliable, but the accuracy of the information cannot be guaranteed. Past performance does not guarantee any future results. For additional information about Julius Wealth Advisors, including its services and fees, contact us or visit www.adviserinfo.sec.gov.

References:

1. Fannie, Freddie Expected to Back Mortgages of Nearly $1 Million- NAR.com

2. Reviewing How TCJA Impacted Mortgage Interest and State and Local Tax Deductions – TaxFoundation.Org