A generation ago, a typical retirement discussion usually included a reference to, or illustration of, the “Three-Legged Stool.” This was an analogy to describe the three most common sources of retirement income: pensions, personal savings, and Social Security.

While many from the previous generation enjoyed a stable retirement from the three-legged stool model, changing circumstances are rocking each of these retirement sources. As Mary Beth Franklin puts it in Investor News, the three-legged stool looks “more like a pogo stick for many Americans.”

Sometimes the best way to explain the details is with pictures. Here are two charts that, along with short explanations, articulate the shaky current status of these three retirement assets.

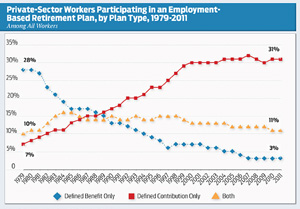

Pensions

Three decades ago, almost two-thirds of all private-sector employees had a defined benefit, company-funded pension. Today, private-sector pensions are almost extinct. Instead, future retirees have defined contribution plans. And most of the contributions come from their pockets, not the company’s, as employer matches have declined or been eliminated during the recent recession.

Social Security

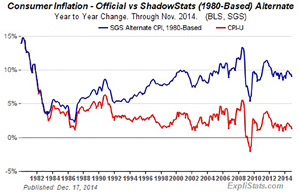

Dennis Miller, a CBS MarketWatch columnist, noted in a recent commentary that because retirement benefits are tied to the changing standards for the Consumer Price Index, “Social Security is not keeping up with the times.”

Miller says that consistent measurements of inflation used by the US since 1980 show a far different picture of rising costs. If the “shadow” figure for inflation is correct, it means “Washington has been cutting Social Security payments for years, just in a way that wasn’t obvious to most newscasters and taxpayers.”

The pictures aren’t pretty, and probably aren’t going to get better in the future.

Fortunately, it’s possible to implement a successful retirement plan without relying on a company pension or Social Security. But the approach requires personal savings and puts most of the responsibility on the individual to see the plan through to completion.

Now, perhaps more than ever, the difference between a rewarding or subsistence retirement depends on an individual’s financial program.

By Elozor Preil