As the conflict continues, many are already predicting what the real estate market in Israel will look like once the war ends. Most people are expecting there will be a significant price surge due to a shortage of supply and huge demand.

Demand Is Naturally Rising—And Set to Soar

Even in normal times, demand for real estate in Israel steadily increases. This is driven by Israel’s high birth rate, leading to continuous population growth. While according to statistics for population to grow you need an average of 2.1 kids per family, in Israel the average is no less than 3.5 kids per family. Add to that the life expectancy, which goes higher and higher due to modern medicine, and the demand for living space keeps on growing.

On top of this, history shows that conflicts often result in a post-war baby boom, which will only amplify the long-term demand for housing.

But this isn’t the only source of demand. Global antisemitism is at its highest levels in 70 years, pushing many Jews from abroad to consider buying property in Israel, including people who never thought before about buying here, whether as a permanent home, a vacation spot or simply a “safe house” option. Israel is truly a unique country in many ways, but particularly with regards to its real estate. In any other country in the world that is going through a war, you would expect people to avoid it, and for real estate prices to go down. But in Israel during this war, we have not seen the demand or prices going down. Despite the war, and even because of the war, Jews around the world want to own a piece of real estate in the Holy Land. Zionism and the desire to connect with the Jewish homeland play a crucial role, with many motivated by the need to secure a place at the forefront of Jewish existence.

Additionally, many foreign nationals are looking at Israel not only as a religious or ideological home but also as a refuge from rising antisemitism. We’ve already seen spikes in inquiries and purchases from Jewish communities worldwide. This surge is expected to grow even more once the conflict stabilizes, especially from those seeking both security and solid investment returns.

Favorable Mortgage Rates for Foreign Buyers

Israeli mortgage rates, which are around 2.5%-3% lower than the average in other countries, add another layer of appeal for foreign buyers. Some of our clients have told us they can get a return on their money guaranteed by the banks in their hometowns—at a higher percentage than the mortgage rates. This financial advantage makes investing in Israel not only a safe option but also a smart economic move, especially for those looking for long-term investment returns.

Supply Issues: Construction Delays, Labor Shortages and Rising Costs

On the supply side, the situation is challenging. According to reports, more than half of Israel’s construction sites are operating at reduced capacity due to labor shortages. Many workers are serving in the military, leaving ongoing projects in limbo, while a significant portion of the workforce, particularly Arab workers, are currently not working in Israel. Additionally, the war has disrupted supply chains—embargoes like the one from Turkey have limited the availability of key construction materials, upping costs as developers may need to source materials elsewhere, and they are further away and pricier. These supply-side constraints are significant, making it harder to meet the rising demand for housing.

Increase in Olim to Israel: Adding to Population Growth

It seems that the number of olim (immigrants) has not decreased even during this time of war, and a notable increase in olim to Israel is also expected after the war, as many Jews worldwide seek security. These olim often arrive with families, further boosting the population and adding to the already increasing demand for housing. Many buyers have put plans on hold, waiting for greater stability. When they reenter the market, we’ll likely see a flood of new demand, creating an even more competitive environment for properties.

Supply and Demand Set the Stage for Rising Prices

The combination of steadily increasing demand (both natural and driven by external factors), coupled with serious supply shortages, sets the stage for a price surge post-war. As global Jewish communities continue to seek safety and connection in Israel, and as supply remains constrained by construction challenges, the fundamentals all point toward higher real estate prices once the dust settles.

Now is the time to act. If you’ve been considering investing in Israeli real estate, don’t wait until prices climb even higher. Whether you’re motivated by securing a safe haven, supporting Israel, or making a smart financial move, taking the first step today could put you ahead of the curve. Reach out to experienced real estate professionals and start exploring your options before you say, “Should’ve, could’ve, would’ve.”

The information provided in this article is for informational purposes only and should not be construed as legal or financial advice. The opinions expressed herein are those of the author. Readers are advised to consult with qualified professionals for specific advice tailored to their individual circumstances. The author and any affiliated parties shall not be held liable for any decisions made or actions taken based on the information contained in this article.

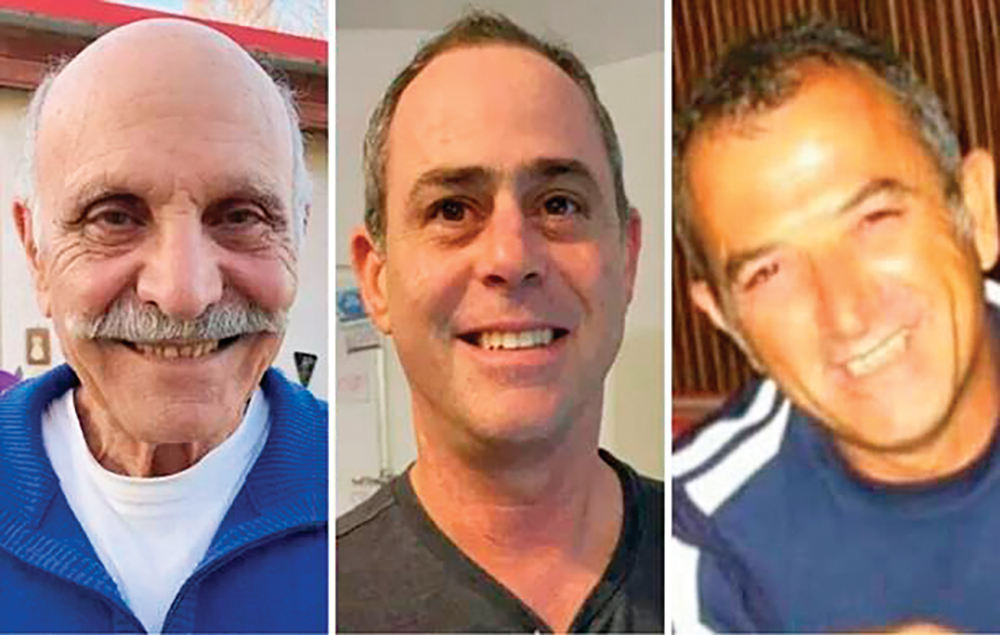

Sammy Dweck Fragin oversees business development and client management at Haim Givati & Co.—The Experts in Israeli Real Estate Law. The firm specializes in property law and has bilingual lawyers who guide foreigners through every step of the process. You can learn more about their firm at https://givatilaw.co.il or email Sammy at [email protected].