Not just yet. But as we watch summer slip away, it is hard to believe it’s almost over. Nobody wants to think about snow and ice when we are sitting outside enjoying fresh mountain air and swimming at the beach. It often seems that when we are enjoying good times, we forget about the challenging moments, acting as if good times are here to stay.

For the last few years, people have been able to take advantage of low interest rates by refinancing existing mortgages or purchasing a new home. Many people, convinced rates will stay low, have used adjustable rate loans as well as home equity lines of credit to finance their homes. Why lock into a higher fixed rate when I can pay less with an adjustable, they argued. And, so far, they have been right.

The question to ask now is, can we truly expect mortgage rates to stay at this level? For several years many advisers suggested rates might increase at any time, and urged borrowers to trade adjustable loans into fixed rate loans. Those who stayed with low, adjustable loans certainly did better. Betting on global problems in places like Russia, the Middle East and China has certainly paid off as such problems have kept rates low. Recent events in China have reinforced this opinion as rates dropped last week. Many still argue the benefit of staying in low, adjustable-rate loans.

Perhaps they are right? Why change course when the route they have chosen has worked well? Let’s explore the benefit of the short-term adjustable loan versus the 30-year fixed loan. Today, the five-year arm is approximately ¾ percent lower than the 30-year loan. The five-year arm provides for a fixed rate for five years after which the rate could jump as much as five points, if rates increase. A five-year arm for a 500,000 loan at 3 percent would cost $2,108 per month. The 30-year option for the same loan at 3.75 percent would be $2,315. So we see that the benefit in this loan is $207 per year for the first five years. While this certainly is a significant benefit, what is the risk.? If rates increase by just two points and the new rate is five percent for the rest of the loan, you will be paying $2,592, or $277 more per month for potentially 25 years. At six percent, the payment would be $2,857 or $542 more per month.

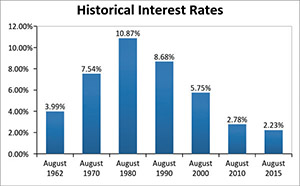

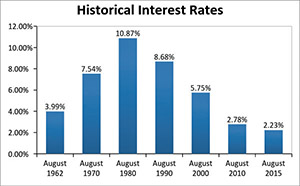

The chart above tells us where rates have been. Do we really believe rates will never approach those levels again? Do you want to take that risk on your home, likely your single largest investment? Will you be able to afford monthly payments if rates do increase as indicated above? There certainly are instances where short term loans make sense, where the borrower expects to move in the next few years or plans to prepay and end the mortgage early. However, what if this is going to be the family homestead for many years?

In a few months we will read about the seven years of plenty in Egypt. As we all know, most people didn’t plan ahead and enjoyed the bounty, assuming it would just continue. I am reminded of investors in 2000 who felt internet stocks would never stop rising and in 2006 the same people felt real estate just could never drop in value.

As I step outside into 90 degree plus heat, it’s hard to imagine that summer will end. Perhaps there is a new paradigm that will prevent the cold weather from returning. The warm weather is here to stay. No need to go to Florida in January because it will be 65 degrees here.

Unfortunately, we know the summer must end. We know what follows and we will soon be buying warmer clothes and taking precautions to plan for what is inevitable. Those banking on low rates have been correct and it has been comforting to relish in the knowledge they were correct. However, will they be correct tomorrow, or in one month or in one year? Perhaps it is time to consider the consequences of being wrong and watching the good times disappear. Perhaps it is time to make a change.

Winter is coming

David Siegel is a Home Lending Specialist with Citibank in its Englewood office. Siegel can be reached at david.siegel@citi.com or 201-419-1330. Ask for rates for purchase loans for balances over $418,000.

By David Siegel