Are you ready to embark on a financial journey that defies all expectations? Welcome to our latest quarterly commentary, diving into the past two years’ extraordinary market narrative, and how this can lay the foundation to a future you get excited about.

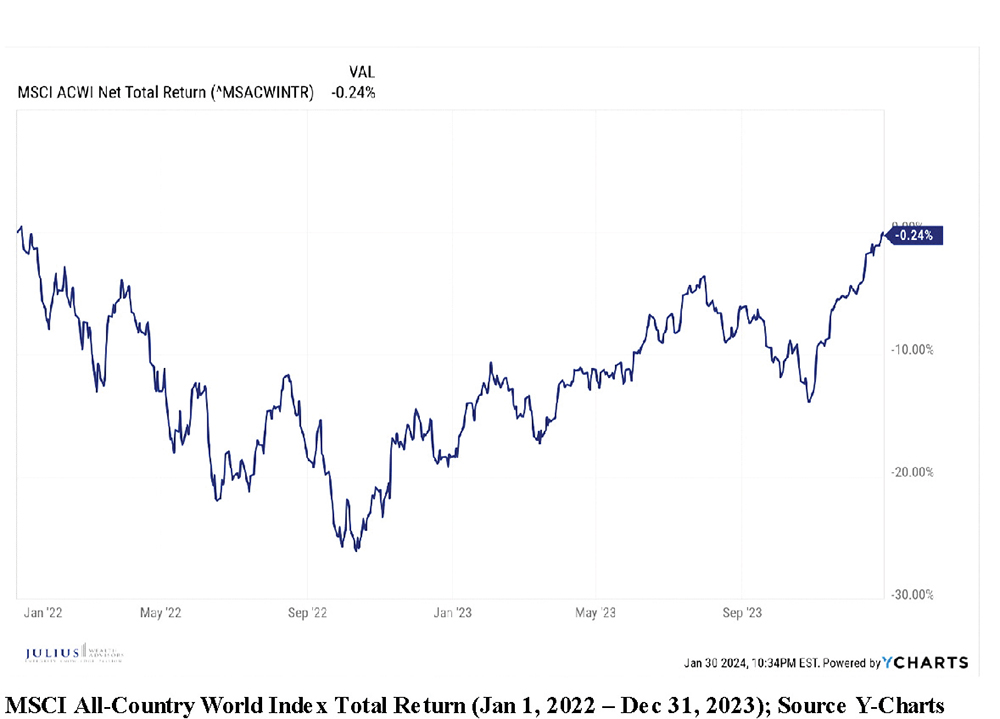

Picture a roller coaster, its steep descents and soaring ascents mirroring the stock market’s tumultuous path from 2022’s dramatic 18.4% downturn to the remarkable 22.2% recovery in 2023 (as measured by the MSCI ACWI). More than a test of nerve, this period underscored a pivotal investment lesson: the power of commitment to high quality businesses and a focus on long-term discipline over short-lived market noise.

Through this lens, we’ll explore these shifts, drawing unexpected parallels to the imaginative world of Willie Wonka. Join us on this enlightening exploration where we unravel market dynamics to discover insights that transcend the mere numbers.

‘A Tale of Two Years’

As we reflect on the past two years in the financial world, one can’t help but draw parallels to Charles Dickens’ classic novel, “A Tale of Two Cities.” Much like the dichotomous settings of Paris and London amid the revolution, the years 2022 and 2023 in the stock market presented a stark contrast of tumult and tranquility. Dickens’ famous opening lines, “It was the best of times, it was the worst of times,” appropriately encapsulate the financial journey we’ve witnessed.

The year 2022 was riddled with uncertainty, high inflation and geopolitical upheavals, echoing the unrest and turbulence of Dickens’ portrayal of Paris. In contrast, 2023 emerged as a period of recovery and resilience, reminiscent of the more stable and hopeful atmosphere of London. This juxtaposition of despair and hope, volatility and stability, perfectly mirrors the rollercoaster of emotions and outcomes experienced by investors during these two eventful years in the financial markets.

In 2022, the financial markets were engulfed in a storm of challenges. Investors navigated a landscape marred by high inflation, aggressive Federal Reserve policies on interest rates, significant tech sector downturns, and global conflicts. These factors collectively contributed to a considerable decline in stock values and a pervasive environment of uncertainty. The relentless news cycle fed into the market’s emotions, testing the resilience and strategic fortitude of “investors.”

Fast forward to the end of 2023 and the picture was strikingly different yet oddly similar in its outcome. After a year of recovery and resilience, the stock market gradually recouped most of the losses incurred during 2022. This period of resurgence, fueled by a rekindled sense of optimism and strategic adjustments, led to a restoration of balance in the market. Despite the continued presence of global economic pressures and geopolitical tensions, the market’s rebound highlighted the often underappreciated truth of the investment world: the importance of long-term discipline and the transient nature of short-term emotionally driven noise.

Now, imagine if you had fallen asleep at the onset of 2022 and awakened at the end of 2023, only to find that, despite a rollercoaster of events, the market stood remarkably flat. This hypothetical scenario encapsulates the extraordinary journey of the financial markets over these two years, a period marked by high drama yet ending in an almost surreal calm.

A Tale From ‘Wonka’:

Lessons in Belief and Resilience

During the holiday season, I went to the movie theater to watch “Wonka” with my wife and two young kids. If you haven’t seen it, I encourage you to do so. As I watched, it reminded me of the profound lessons it imparts, lessons that I hope resonate deeply with my kids. In this enchanting narrative, we are transported to a world where imagination and belief are not mere fantasy but powerful forces that shape reality. This story underscores a truth that is equally vital in the realm of building long-term sustainable wealth: the power of belief in one’s abilities and the reality that dreams, with the right blend of vision and strategy, do indeed come true.

As I reflect on the financial journey from the stormy 2022 to the resilient 2023, the story of a young Willie Wonka serves as a beacon of inspiration. It teaches us that in the unpredictable world of finance, much like in Wonka’s journey to owning a chocolate factory, a steadfast belief in our strategies and abilities is essential. We learn that the path to financial success is not linear but filled with twists and turns, requiring resilience, creativity and the courage to dream big.

In essence, “Wonka” is more than just a movie I watched with my family this past holiday season; it’s a reminder of the invaluable role of imagination and belief in our financial journey. It’s about seeing our investment path as an adventure, where challenges present opportunities for growth. This story inspires us and our future generations to approach finance not just with analytical rigor but with the same sense of wonder and possibility that Willie Wonka embodies, leading us toward realizing our most ambitious financial dreams and goals.

What Will Be Your Tale in 2024 and Beyond?

As we leave behind the roller coaster of 2022 and 2023, we find ourselves at a crucial juncture, facing the essential question: What story will you write in the financial landscape of 2024 and beyond? The past couple of years, akin to the dramatic narrative of Dickens’ “A Tale of Two Cities,” were marked by high inflation, aggressive Fed policies and global uncertainties. Far from being mere hurdles, these years have been transformative, imparting key lessons that should hopefully shape your financial strategies moving forward. Key insights from this period include:

The importance of resilience in the face of market volatility;

The value of long-term strategic planning over reacting to short-term noise and emotions;

The necessity of maintaining a disciplined focus on high-quality investments.

These lessons underscore the need to adapt, learn and grow in our financial journey, which is much more than just numbers and trends — it’s a reflection of our aspirations, strategies and core beliefs. As we look ahead, we are challenged to determine the legacy we wish to create. Will our financial narrative be one of unwavering resilience, innovative foresight and the fulfillment of our grandest financial aspirations?

This is our call to action. Let’s embark on this journey with integrity, knowledge and passion, ready to shape a financial future that’s not just a story to be told but a legacy to be built. Are you prepared to write this next chapter and turn your financial dreams into reality? The time is now — let’s seize it with fervor and purpose. Together, let’s craft our stories for 2024 and beyond!

Jason Blumstein, CFA® is the CEO and founder of Julius Wealth Advisors, LLC (www.juliuswealthadvisors.com) a registered investment adviser in Englewood Cliffs, New Jersey. He is also the host of “The Big Bo $how” podcast available on YouTube, Spotify and Apple podcasts. Jason has been investing and educating himself on personal finance since the age of 10. His company’s mission is to empower people to live their best financial lives while fostering an ecosystem of integrity, knowledge and passion! Jason currently resides in Englewood with his wife and two kids. He can be reached at (201) 408-4644 and/or [email protected].

Disclosures

This piece contains general information that is not suitable for everyone and was prepared for informational purposes only. Nothing contained herein should be construed as a solicitation to buy or sell any security or as an offer to provide investment advice. The information contained herein has been obtained from sources believed to be reliable, but the accuracy of the information cannot be guaranteed. Past performance does not guarantee any future results. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. For additional information about Julius Wealth Advisors, including its services and fees, contact us or visit adviserinfo.sec.gov.