Englewood officials are trying to come up with solutions to mitigate the effects of the new cap on property tax deductions, but they are running into a large brick wall known as the IRS. Mayor Frank Huttle sent a letter to residents in December, allowing them to prepay 2018 taxes for the full year and receive the benefit, if done by December 31. But then the IRS informed city officials that

homeowners can only deduct what has already been assessed and that means just the first two quarters. Englewood’s chief financial officer, Michael Kaufmann, said 30 percent of Englewood homes have a tax bill above $10,000; the average is $12,201.42. Kaufmann said the city collects $30 million a quarter and got an extra $10.5 million pre-paid.

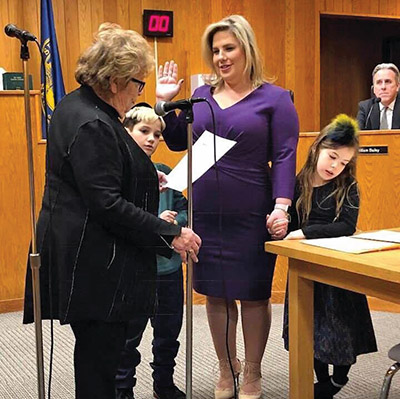

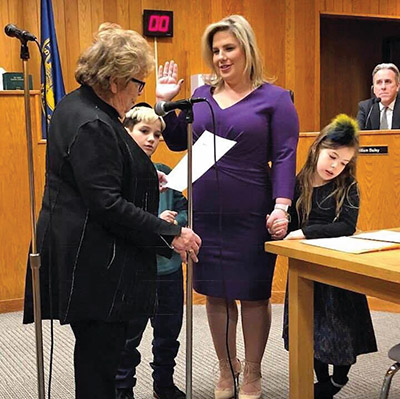

New Jersey Congressmen Josh Gottheimer (D-Wyckoff) proposed setting up charities that will allow homeowners to donate the amount of their property taxes and receive a credit, as charitable contributions aren’t capped. Newly installed first-ward city council member Cheryl Rosenberg said some council members are asking city attorneys to look into this, but she doesn’t see it as a viable option just yet. “I would love to pursue options that would help Englewood but I am skeptical about this particular path.” She noted that charitable contributions cannot be mandatory and also count for a tax deduction, but property taxes are mandatory. Treasury secretary Steven Mnuchen has called the idea “ridiculous.” The IRS hasn’t commented.

How much money is at stake for Englewood homeowners? Kaufmann gave a hypothetical example. Mr. and Mrs. Homeowner have an income of $100,000. They pay $25,000 annually in property taxes. Now they can only deduct $10,000 off their income so they are paying taxes on $90,000 instead of $84,000. That’s an additional tax bill of $6,000. If they have a tax rate of 25 percent, that’s another $1,500. Owners of properties in Englewood with a $40,000 or $50,000 tax bill will owe thousands more.

The city is already bracing for another possible spending increase. Rosenberg said it is likely that the incoming administration and Governor Murphy will not renew the two percent arbitration cap put in place by Governor Christie on increases that police and firemen can get when negotiating their contracts. “This will put the town in a tough spot,” Rosenberg said. “We could see a significant increase in the budget. We have excellent police and firefighters and we want to give them benefits. But it will be a strain on the budget for towns that have sizable police and paid fire departments like Englewood and Teaneck.”

Rosenberg said New Jersey is not “user friendly” to the wealthier population. Besides high property taxes, New Jersey doesn’t get the tax breaks that other states do. The 529 plan to save for college is deductible in 35 states but not in New Jersey.

Englewood officials fear a possible domino effect of people moving and property values falling, leading to a loss of the revenue for municipal and education funding. And then there would be only two ways out: cut spending or raise taxes. Or both.

“Socio-economic diversity is key to a town like ours,” Rosenberg said. “People paying $50,000 in taxes help support the school system and community resources. We don’t want those people moving out. We want to help everyone.” She said it is now critical that properties be assessed in the right time frame or there could be many tax appeals which can be very harmful as they come exclusively out of the city budget, although taxes are paid to the city, the board of education, the county and the library.

Meanwhile, the accountants are “scratching their heads,” Rosenberg said. They still don’t know what’s deductible and what isn’t. The new tax bill is better for some, worse for others. “Not only don’t we understand the impact on individuals, we have no real idea how it will impact the city in the next three years. We need to make sure in planning that there’s a surplus. But until we pay taxes next year, the impact will be hard to see.”

By Bracha Schwartz