It doesn’t take a lot of money in terms of down payment and closing costs to buy a home. There are many new programs on the market and several ways to structure a mortgage loan. The less you put down, the greater the starting mortgage balance and the larger the payment; therefore, the more in income you need to qualify. For loans in the amount of $424,100 (Fannie/Freddie conforming ceiling amount for single families) even one percent down is possible. In the million-dollar range, 5-10 percent down is considered a low down payment. For many first-time homebuyers, the big question is “Where do I scratch up the dough?”

Some suggestions: Mom and Dad, Grandma and Grandpa, best friend, or just maybe you worked during school and saved your own money. Reallocating the use of funds may be a consideration, such as swapping a big roll-out-the-red-carpet wedding for a smaller, low-key wedding and a home down payment; not going away for holidays and redirecting the funds for a home down payment; trust funds, retirement funds, stock investments or just skipping the Dunkin and Starbucks. Sellers’ concessions and contributions can be a part of getting to the finish line as well.

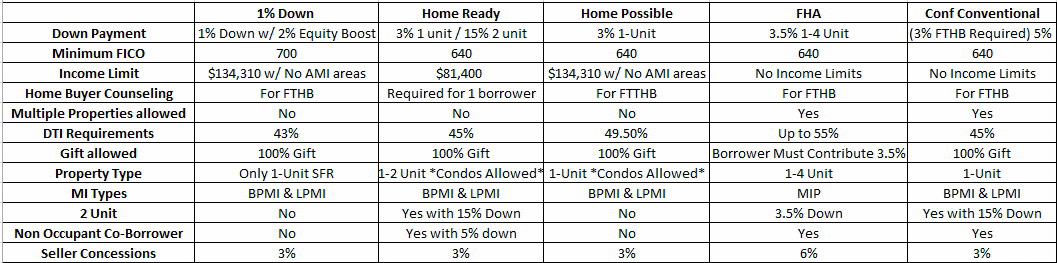

A summary chart of the low down payment programs are available below. Keep in mind that there are specific underwriting guidelines that go along with each program, as well as tiered mortgage rates based on credit scores.

Abbreviation key:

FTHB-First time homebuyer BPMI-Borrower paid mortgage insurance LPMI- Lender paid mortgage insurance SFR-Single family residence Equity Boost- Lenders contribution

Jumbo loans do not appear on the chart because they are not government loans but generally securitized or large investor products. Five percent can be achieved and may require splitting the loans into a first and 2nd second mortgage.

Credit Tips: When you make the decision to begin looking for a house, that’s the time to check your credit scores. Everyone knows the better the score the better the rate, but when it comes to low down payment deal structures, the lower the credit score the greater the adverse impact on rate and the cost of mortgage insurance as well.

Now the FTHB millennial knows what to do, but sellers have to go somewhere in order to sell their home to the FTHB. Many sellers consider renting. There are two strategies I would like to suggest:

You can be a FTHB homeowner or second-time home owner if you take the time to piece together all the sources you have to work with.

By Carl Guzman

Carl Guzman, NMLS# 65291, CPA, is the founder and President of Greenback Capital Mortgage Corp., a Zillow 5-star lender http://www.zillow.com/profile/Greenback-Capital/Reviews/?my=y. He is a residential and reverse mortgage financing expert and a deal maker with over 26 years’ industry experience. Carl and his team will help you get the best mortgage financing for your situation and his advice will save you thousands! www.greenbackcapital.com ceg@greenbackcapital.com