I’m not talking about doing the limbo. I am talking about the minimum amount of money you need to become a homeowner. Believe it or not, it doesn’t take much. There are just enough low down payment programs for most borrowers. For loans in the $417,000 area, 1 percent is possible. In the million dollar range, 10 percent down is considered a low down payment.

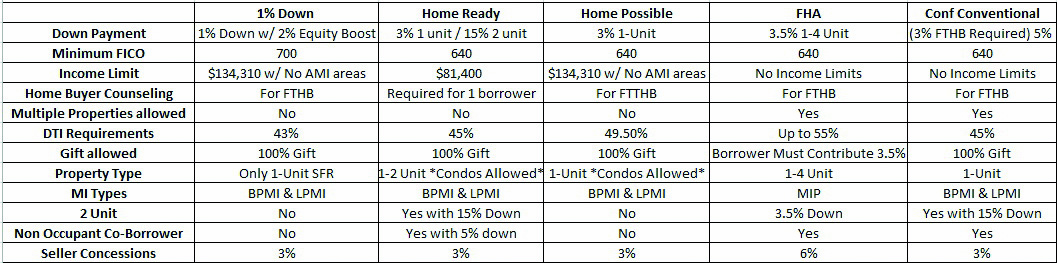

A summary chart of the low down payment programs are available below. Keep in mind that there are specific underwriting guidelines that go along with each program, as well as tiered mortgage rates. Working with a mortgage professional who can help you navigate the program choices can help set you to become a homeowner.

Abbreviation key:

FTHB—First time homebuyer BPMI—Borrower-paid mortgage insurance LPMI—Lender paid mortgage insurance SFR—Single family residence Equity Boost—Lender’s contribution

The important takeaway is that between some savings, seller’s concessions, lender contributions and maybe even some gift money from family you can be a homeowner.

Carl Guzman, NMLS# 65291, CPA, is the founder and president of Greenback Capital Mortgage Corp., a Zillow five-star lender http://www.zillow.com/profile/Greenback-Capital/Reviews/?my=y. He is a residential and reverse-mortgage financing expert and a dealmaker with over 26 years’ industry experience. Carl and his team will help you get the best mortgage financing for your situation and his advice will save you thousands! www.greenbackcapital.com ceg@greenbackcapital.com