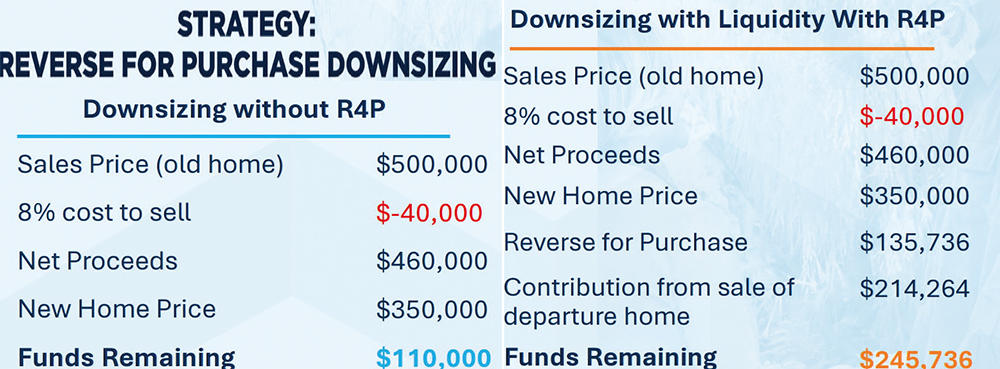

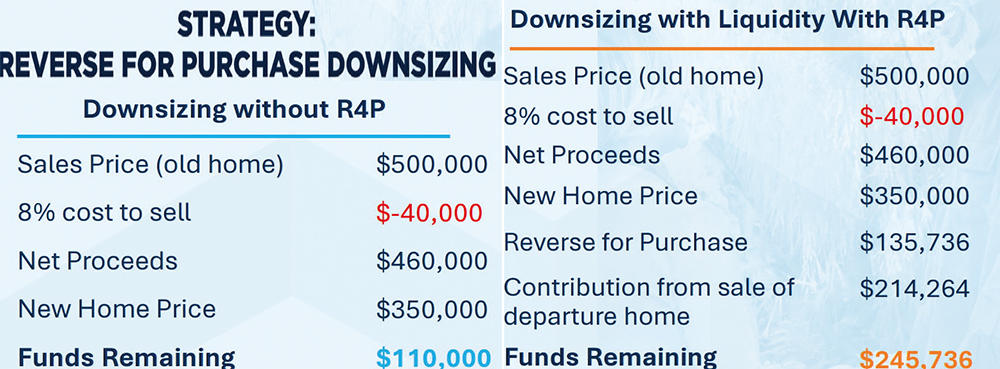

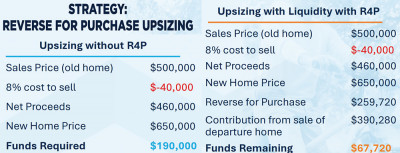

Generally, when someone thinks of reverse mortgages, they think of paying off an existing mortgage and/or pulling cash from an existing primary residence. Did you know that you can actually buy a new home (primary residence) with a reverse mortgage? You can actually sell your current home, and instead of taking a new “forward mortgage” (the regular mortgage with a monthly payment). You can borrow via a reverse mortgage for purchase and retain your cash and eliminate monthly principal and interest payments.

The borrower makes an initial down payment, which is the difference between the loan amount (known as the principal limit) and the sales price plus any closing costs. The borrower has ownership, has no required repayment of the loan until death, sale of property, or just moving elsewhere. Real estate taxes, insurance, and HOA dues have to be paid as expected.

There are positives and negatives to all mortgage products. The key is to make sure that when you take any financing, it aligns with what you are trying to accomplish. Due to limited time availability and deadline pressures, some advisors are quick to negate an option because they are not familiar with the product. Take it upon yourself to understand the options and then meet with your advisor.

Let’s talk about the advantages:

1. You preserve cash instead of paying all cash.

2. You eliminate a monthly mortgage payment.

3. You preserve your stock portfolio instead of selling off to pay all cash or take a forward mortgage plus down payment.

4. You can structure the reverse mortgage so that you use a portion to close and leave an untapped credit line portion so that you take advantage of line growth. (There is a growth factor on a reverse mortgage. Any unused portion of the line grows, and if you allow that, over the years you have more tax-free money available when needed.)

5. A reverse mortgage can be used for planning the following:

a) Provide funding for healthcare or medical treatment: Within one’s budget, there is a need for long-term care planning to both protect one’s assets and remove any potential burden on family. Many seniors may be forced to use their savings and/or their monthly income for long-term care coverage. A reverse mortgage allows seniors to stay in their homes, be self- sufficient and not deplete all their savings or income to buy a new home.

b) Funding for estate taxes: If a reverse mortgage line is tapped to fund life insurance, the total estate value subject to taxes is lowered by providing life insurance proceeds for the homeowner’s heirs to pay estate taxes.

Generally, the full value of a home is subject to estate tax, but a reverse mortgage lien reduces its value, lowering estate tax (consult your tax estate specialist). At death, the full value of the property would not be included in estate valuation for tax purposes. The accumulated debt of the reverse mortgage would effectively reduce the property value and may lower any applicable estate taxation. In addition, accrued interest in the reverse mortgage may be available as a tax reduction upon repayment of the loan.

c) Additional income can be generated if you buy a two-family house. Occupy one unit and rent out the second. With no mortgage payments, you have now created another source of income.

Cons: The principal balance increases over time, so planning becomes important in order to make sure that the reverse mortgage financing tool puts you in a better financial position overall.

Carl Guzman, NMLS# 65291, CPA, is the founder and president of Greenback Capital Mortgage Corp., a Zillow 5 star lender. He is a residential and reverse mortgage financing expert and a deal maker with over 26 years of industry experience. Carl and his team will help you get the best mortgage financing for your situation and his advice will save you thousands. Visit him at www.greenbackcapital.com or [email protected].